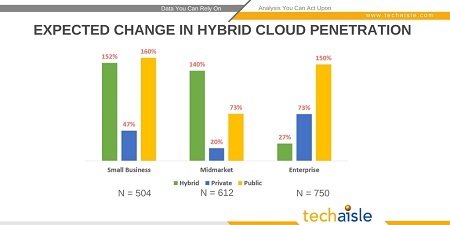

Techaisle’s SMB and Midmarket Cloud adoption survey of 3200 midmarket firms and 3000 small businesses globally shows that hybrid cloud has been gaining momentum in small businesses, and is already entrenched in the mid-market firms. Hybrid accounts for 37 percent of cloud using mid-market businesses today, up 28% from 2018, and is expected to capture a lot higher proportion of new spending in the next one year. Midmarket firms are moving from public clouds to hybrid deployments with current hybrid workload at 17%, up from 12% in 2018. The current penetration is the highest in the US but planned usage is highest in Europe and Asia/Pacific.

There is no clear trend on the types of workloads on hybrid environments which shows that most deployments are very specific to a customer’s needs and application delivery partner’s expertise. Typical hybrid workloads include ERP, HR, CRM, finance, operations, IoT, analytics, AI, Machine Learning, SAP 4/HANA deployments, disaster recovery, critical event management, mass storage, cloud security and cloud database. Both Azure and AWS are being used by over 90% of US midmarket firms. Red Hat OpenStack is the preferred private cloud platform for 74% of US firms and Red Hat Cloudforms is the most used cloud management solution by 80% of US midmarket firms followed by VMware vRealize. Hypergrid, Morpheus, platform9 and Scalr are in low single digits. Ansible is being used by most channel partners for orchestration and automation.

Corresponding Techaisle survey with partners delivering cloud solutions to SMBs and midmarket customers reveals that Azure Stack is the most popular platform because of Microsoft’s proactive engagement, powerful and extensive Microsoft ecosystem as well as deep product portfolio. Google Anthos and AWS Outposts are picking up pace. Interesting trend is being seen from AWS partners who are beginning to use Google Anthos instead of AWS Outposts. These partners are not only working with AWS native solutions, but offering cloud solutions which are based around other cloud platforms like GCP, Oracle or Microsoft. Some of these partners prefer to use Anthos because they find it to be more of an open technology and AWS Outposts and can be easily implemented across other environments. It gives them a wider approach in terms of compatibility. They have to pay a fixed amount when using using Anthos which is variable with Outposts. None of the application delivery partners are using tools and technology from only a single vendor. The use of Open Source is dominant.

Another view of the data collected in the survey provides fascinating insight into the extent that midmarket cloud users are willing to align different delivery methods with internal requirements. Detailed analysis and segmentation of data reveals that there are pockets of demand (and overlap in these pockets) that exist for public, private and hybrid models in each segment.

Mid-market businesses

Looking at the mid-market segmentation, we see that larger firms are likely to employ multiple cloud delivery strategies. Overall, 51 percent rely on a single delivery approach for cloud, for example, 31 percent use only private. 29 percent of mid-market businesses use two different delivery approaches, with the most common being a combination of private and public models (but not in a hybrid setting). Firms in these overlap areas are not, on average, larger than those using a single delivery method, but they do face added complexity in that they tend to have more locations.