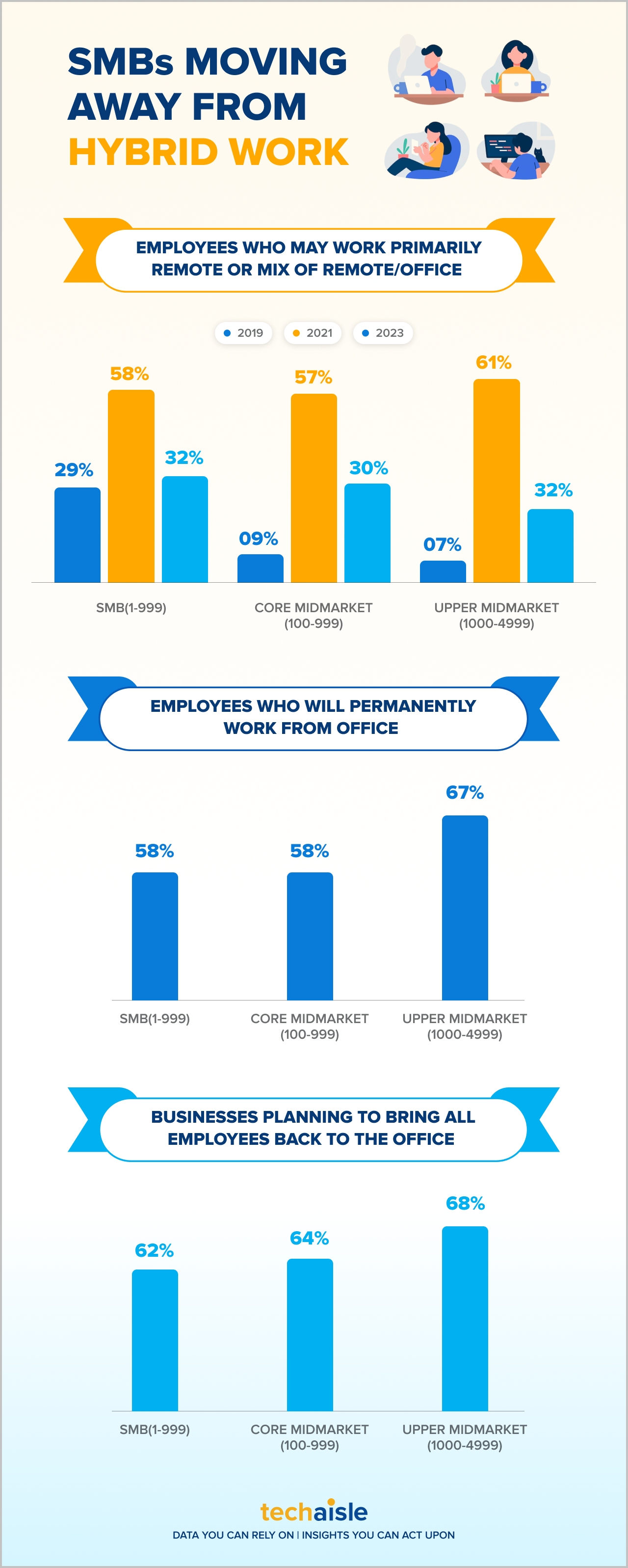

In the ever-evolving technological landscape, businesses often stand at a crossroads, compelled to adapt to emerging trends and customer needs. HP, a renowned player in the personal computing arena, remains committed to adapting to changing trends and meeting customer needs. This year alone, the company has unveiled over 150 products. At the inaugural HP Imagine 2023 event, it showcased a range of products and solutions centered around three key trends shaping its offerings: workplace flexibility, the use of AI to enhance productivity and transform PCs into “personal companions,” and the importance of trust—aligning HP’s values with its customers, with a strong focus on sustainability.

HP has demonstrated its adaptability by launching two innovative products: the HP Spectre Foldable PC and the HP Envy Move. It has also introduced Managed Collaboration Services and HP Protect and Trace with Wolf Connect to address users’ productivity and endpoint security needs. Furthermore, it has expanded its collaboration offerings with the launch of the Poly Studio R30+ Bundle. The company also emphasizes enhancing partner growth and customer experiences, as evidenced by its partner ecosystem, including the HP Amplify program.

HP’s Innovative Solutions for Flexible Work Environments: The Spectre Foldable PC and Envy Move

HP’s innovation is significantly driven by what it calls the ‘era of flexibility.’ The swift shift towards hybrid and remote work arrangements in recent years has necessitated organizations to adapt to fluctuating work environments. Consequently, HP is dedicated to offering adaptable solutions, such as devices that effortlessly adjust to diverse work settings, ranging from kitchen counters to executive boardrooms. In alignment with this commitment, it has unveiled two state-of-the-art products – the HP Spectre Foldable PC and the HP Envy Move.

The HP Spectre Foldable PC touted as the world’s thinnest and smallest foldable PC, is a 17-inch, 3-in-1 device that serves as a laptop, tablet, and desktop, ensuring versatility and portability. Its foldable screen enables it to morph into a large tablet compatible with a stylus, a 12.3-inch laptop coupled with a detachable Bluetooth keyboard, and a desktop PC equipped with a built-in kickstand. This device offers flexibility without compromising performance, making it an optimal choice for mobile professionals needing a robust and adaptable computing solution.

The HP Envy Move is another innovative device, a 23.8-inch portable PC hailed as the world’s only movable all-in-one PC. This product caters to the needs of home-based workers, offering flexibility and mobility. It can be effortlessly relocated from one room to another without being bound to a power source. Its built-in handle, lightweight design, and self-deploying kickstand make it perfect for remote workers seeking a large screen without the bulkiness of a traditional laptop.

The Future of AI with HP: Personalized PCs and Collaborative Data Science Platforms