Techaisle’s recently completely study US SMB Mobility Solutions Adoption Trends shows that SMBs are more optimistic than they ought to be about their current mobility security profiles, but even so, less than 20% of US SMBs believe that they are “fully prepared” today. Like manageability, security is an important constraint on mobility adoption within the SMB market. Suppliers need to help SMB clients to establish frameworks that protect against both external and employee threats to information security.

In many ways, it is difficult or impossible to isolate security as an issue in mobility. Security is intrinsic to the devices, applications and solutions used by SMB firms that have adopted mobility, and security is an essential factor in supporting the mobile workforce. Techaisle wants to highlight two findings from the US SMB 2015 mobility survey that are specific to security, and which are important to understanding and supporting the SMB mobility market.

Current mobility security posture within SMBs

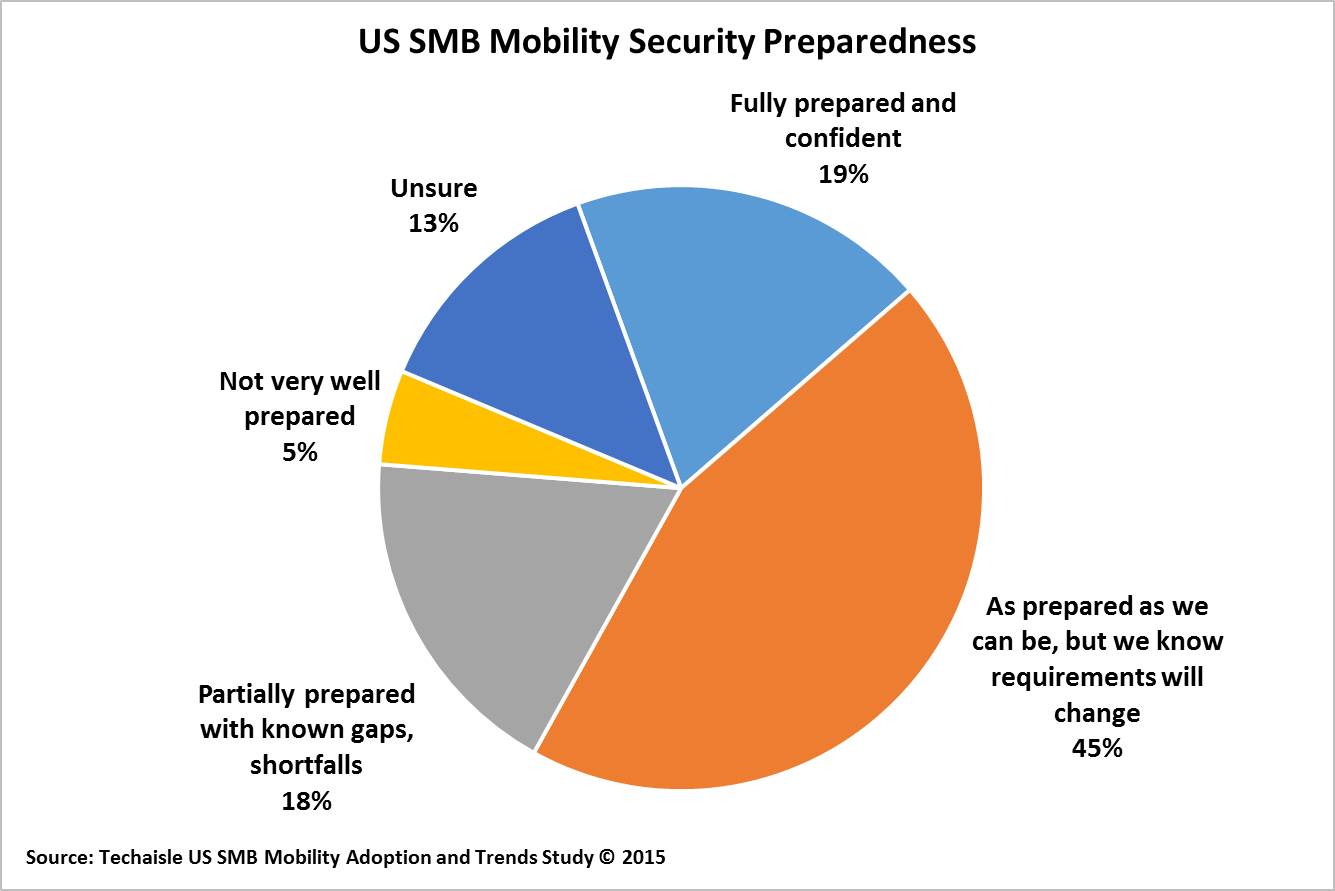

The first of these data points concerns the current mobility security posture within US SMBs. As the data shows, SMBs are cognizant of the challenges associated with securing mobility-dependent workspaces and work patterns. Fully 45% believe that they are “as prepared as we can be,” but acknowledge that “requirements will change.” Nearly 20% state that they are “partially prepared” but have “known gaps and shortfalls,” and other 5% confess to being “not very well prepared.” In reality, it is likely that “partially prepared” describes a much greater swath of the SMB market than these figures suggest: requirements do indeed change continuously, and even firms that are confident that they are “fully prepared” (19%) may find that the threat landscape is more extensive and pernicious than they had imagined. Techaisle is aware that it is hard for suppliers to persuade potential customers that they “ought to want to” be more proactive with security – but with increasing frequency and severity of breaches and attacks, and the exposure that mobility’s flexible perimeter incurs, it is important for suppliers to position their solutions against the reality of the threat landscape rather than the SMB perception of exposure and preparedness.

SMB perception of mobile threat sources: the enemy is inside the tent

Second data point has to do with mobile threat sources. Techaisle survey data shows that the enemy is inside the tent. During the course of the Techaisle SMB 2015 survey, respondents were asked “When it comes to security risk in the mobile computing context, which of the following represents a source of exposure or uncertainty within your organization?” To a (surprisingly) high degree, SMB concerns with mobility security revolve around users. SMB IT respondents ranked three user-attributable issues – user neglect/irresponsibility, lack of user knowledge and awareness, and user mishap/thoughtlessness – amongst their top four concerns, trailing only “general malware infection” as a mobility security threat.